How big is the active optical cable market in the usa?

The active optical cable (AOC) market in the United States is experiencing unprecedented growth, driven by surging demand for high-speed data transmission in sectors like data centers, telecommunications, and consumer electronics. As industries prioritize energy efficiency, scalability, and reliability, AOC cables—which combine fiber optics with integrated transceivers—are emerging as a cornerstone of modern connectivity solutions. This blog explores the current landscape, key drivers, and future prospects of the AOC cable market in the USA, with a focus on innovations like 400G AOC cables.

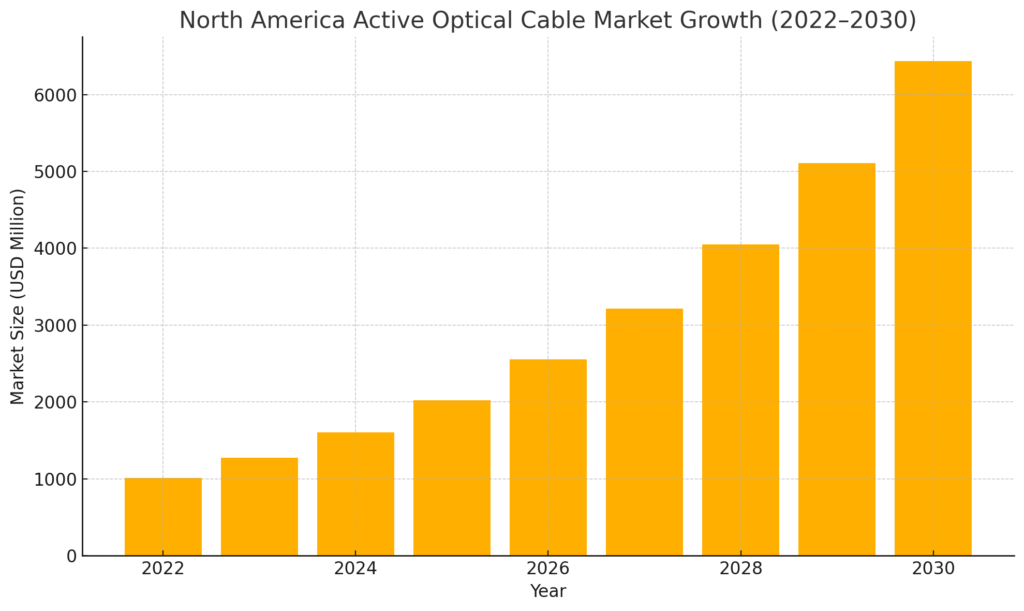

1. Market Size and Growth Projections

The United States dominates the North American AOC Cable market, contributing 35% of global revenue in 2023. In 2024, the global high-transmission AOC market is worth $2.59 billion, of which the United States accounts for about $2.59 billion and the United States accounts for about $900 million. By 2030, the global AOC market is expected to reach $4.43 billion, with a compound annual growth rate of 8.1%. Factors driving this growth include:

Data center expansion: Hyperscale data centers, particularly those supporting AI/ML workloads, require high-density, low-latency solutions. AOCs are preferred for their ability to handle 400G and 800G data rates over longer distances compared to copper alternatives.

5G rollout: The Federal Communications Commission (FCC) estimates 50% 5G coverage in the U.S. by 2025, accelerating demand for high-bandwidth infrastructure.

2. Why AOC Cables Are Gaining Traction

AOCs outperform traditional copper cables (DACs) and active electrical cables (AECs) in critical areas:

Longer transmission distances: AOCs support up to 100 meters without signal degradation, ideal for sprawling data centers.

Energy efficiency: AOCs consume 30% less power than copper-based solutions, reducing operational costs.

EMI immunity: Fiber optics eliminate electromagnetic interference, ensuring stable performance in high-density environments.

The rise of 400G AOC cables exemplifies this shift. Companies like Credo Technology are launching 400G AEC and AOC solutions tailored for AI/ML backend networks, emphasizing low power consumption and ultra-reliability (MTBF of 100 million hours).

3. Key Applications Driving Adoption

Data Centers

AOC cables are the backbone of next-gen data centers. For example, Google’s TPUv4 architecture uses 400G DACs and AOCs for intra-rack connectivity, while Tesla’s Dojo supercomputer relies on custom copper and optical solutions for high-speed interconnects. The U.S. hosts over 8,000 data centers, with cloud adoption pushing this number higher.

Consumer Electronics

Products like OWC’s USB4 AOC cables (40Gbps, 4.5-meter range) and Kramer’s DisplayPort AOC (4K/60Hz over 100 meters) highlight AOCs’ versatility in consumer markets. HDMI AOCs, driven by 8K streaming and gaming, are also projected to grow at a 9.8% CAGR through 2030.

Telecom and Healthcare

5G infrastructure and telemedicine advancements rely on AOC cables for low-latency, high-bandwidth connectivity. The healthcare sector, in particular, is adopting AOCs for medical imaging and remote surgery systems.

4. Challenges and Competitive Landscape

Despite robust growth, the market faces hurdles:

High initial costs: Deploying fiber networks requires significant investment, deterring smaller enterprises.

Technical complexity: A shortage of skilled fiber technicians could slow adoption.

Key U.S. players like Cisco and Broadcom dominate the competitive landscape, while startups like Fibrecross innovate in niche areas like 400G/800G AOCs. Mergers and R&D investments are critical as companies race to meet evolving standards like 1.6Tbps interfaces.

5. The Future: 400G AOC and Beyond

The 400G AOC cable segment is poised to revolutionize AI and cloud computing. LightCounting predicts AOC sales will grow at a 15% CAGR through 2028, though competition from AECs (45% CAGR) remains fierce. Fibrecross’ innovative products designed specifically for 400G QSFP112 interfaces highlight the synergy in addressing the AI boom.

Looking ahead, the integration of co-packaged optics (CPO) and linear drive pluggable (LPO) technologies will further enhance AOC performance, cementing their role in the transition to terabit-era networks.

Conclusion

The U.S. AOC market is a dynamic arena where innovation meets necessity. With data centers, 5G, and AI driving demand, AOC cables—especially 400G variants—are set to redefine connectivity standards. While challenges like cost and complexity persist, the sector’s growth trajectory remains bullish, promising transformative impacts across industries.

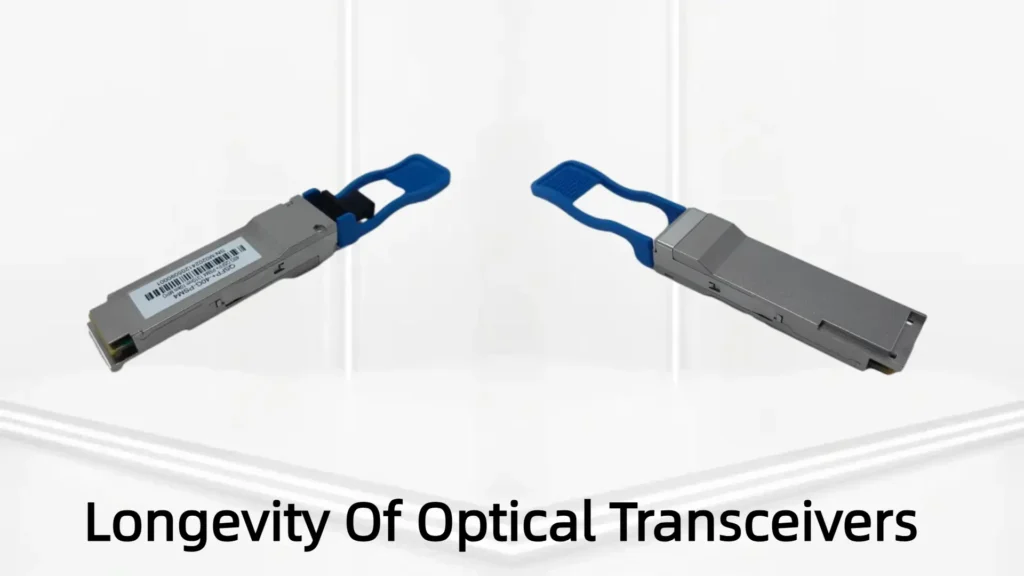

What Is the Lifespan of an Optical Transceiver?

Learn the typical lifespan of optical transceiver modules like SFP+, QSFP+, QSFP28, QSFP-DD, OSFP. Discover factors that affect durability, signs of failure.

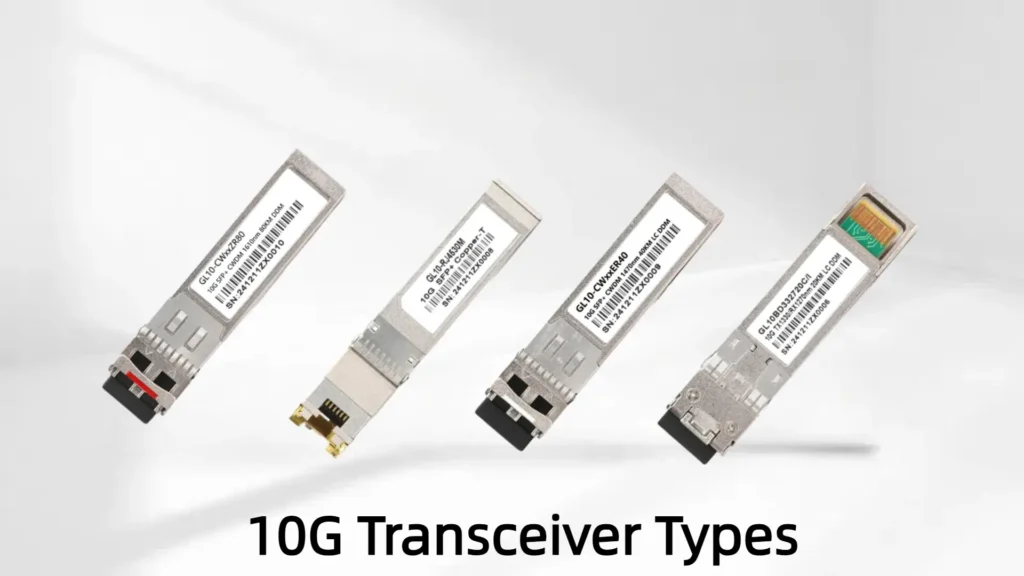

10G Transceivers: Types, Distances & Buying Guide

Learn the real-world differences between 10G transceiver types (SFP+ SR/LR/ER/ZR, copper/DAC/10GBASE-T), distances, use cases and buying tips.

What Is a BiDi Transceiver?

Discover what a BiDi transceiver is, how BiDi optical transceivers work, and why 800G BiDi is shaping the future of data center networking.

OEM vs. Third-Party Optical Transceivers: Which to Choose?

Make an informed choice between OEM and compatible optical transceivers. Practical guidance for IT managers on reliability, vendor support.

How Big Is the 800G Optical Transceiver Market in 2025?

The 2025 global 800G optical transceiver market size, key growth drivers, top players, and forecasts for this fast-growing multi-billion-dollar industry.

Inside the Structure of Active Optical Cables

Learn what makes active optical cables reliable: transceivers, diagnostics, fiber protection and installation tips. AOC cable overview for engineers.