Accelerating Enterprise Networks with Optical Transceiver Factory

Modern enterprise and data center networks demand ever‑greater bandwidth and reliability. Sourcing optical transceivers and fiber optic modules directly from a dedicated factory offers distinct advantages in meeting these needs. A specialized factory can deliver tailored solutions—from standard SFP/SFP+ modules up to cutting‑edge 800G pluggable optics—while ensuring rigorous quality control and cost efficiency. In contrast to generic resellers or single‑brand OEMs, factory‑direct sourcing provides better transparency (batch traceability), competitive pricing, and flexible customization. Choosing where and how you source optics can make or break your infrastructure’s performance, transparency, and resiliency.

The Growing Role of 800G Optical Transceivers

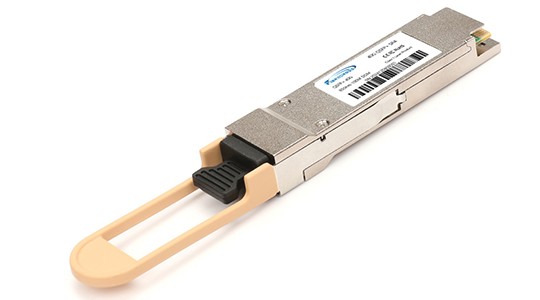

Data centers and enterprise networks are rapidly moving beyond 100G and 400G links. 800G optical transceivers represent the next leap, roughly doubling per‑module bandwidth over 400G. By using advanced signaling (PAM4) and multi‑lane designs (e.g. QSFP‑DD or OSFP), 800G modules handle a surge in data, enabling networks to transmit more data at higher speeds. Key benefits include:

Higher capacity per fiber: 800G optics dramatically expand link bandwidth, reducing the number of parallel fibers or ports needed. This simplifies network architectures and cuts both capital and operational costs.

Space and power efficiency: New 800G modules are compact and power‑optimized. More modules can fit per switch, and cutting‑edge designs improve heat dissipation. Energy per bit is lower, aligning with data center sustainability goals.

Future‑proofing: Adopting 800G today safeguards networks for tomorrow’s demands. Enterprises can upgrade fabrics without complete hardware overhauls, protecting investments. This scalability is crucial as AI, 5G, and cloud workloads explode, since emerging technologies require robust backhaul that 800G transceivers are designed to meet.

Performance under load: High‑speed 800G optics maintain low latency and bit‑error‑rate even under peak AI/data loads. Leading factories test these modules extensively to ensure signal integrity over the intended reach. For example, QSFP‑DD800 supports eight 100G lanes with advanced thermal management to remain stable under heavy load.

For enterprise networks eyeing massive virtualization or AI clusters, 800G transceivers are no longer optional—they are the backbone for expansion. Modules like 800G SR8/FR8 (short‑reach vs extended‑reach) enable both in‑rack and multi‑kilometer links. AI servers require deployment of high‑speed 800G optical modules to facilitate rapid data transmission and minimize latency.

Advantages of Factory‑Direct Sourcing

Working with a dedicated optical transceiver factory (instead of indirect vendors) brings multiple advantages:

Cost & Flexibility: Direct sourcing typically cuts out middlemen, lowering per‑unit costs. Factories can customize optics (wavelengths, connector types, firmware) to fit niche requirements. For global enterprises, this flexibility means optical modules can be tailored for specific switches or compliance regimes.

Quality Control: Reputable factories enforce ISO‑certified Quality Management Systems. ISO 9001:2015 ensures consistent manufacturing processes and fewer defects. Many factories also follow TL 9000 (telecom‑specific QMS) and obtain RoHS/REACH/CE/FCC certifications. These certifications mean each transceiver meets international standards for reliability and safety.

Traceability & Compliance: Leading factories serialize every unit and link it to manufacturing logs. This full traceability streamlines audits and recalls. Without such tracking, meeting strict procurement standards (especially for public sector or regulated industries) is nearly impossible. Global buyers increasingly demand conflict‑mineral and emissions certificates for components—all of which a factory can provide transparently.

Rigorous Testing: A mature optical transceiver factory performs exhaustive testing—before and after assembly. For example, modules undergo measurements of optical output power, extinction ratio, modulation amplitude, and bit‑error rate to MSA standards. Environmental stress tests (temperature cycling, humidity) confirm reliability across operating conditions. By contrast, commodity suppliers may skip such testing. Direct sourcing ensures each batch meets specification, maximizing uptime for mission‑critical networks.

Supply Chain Resilience: Working with a factory (often with multiple production sites) hedges against disruptions. Buyers should look for partners with multiple production sites for failover and load sharing and robust inventory planning. This contrasts with smaller distributors who may source from various unknown factories, risking sudden shortages. Factory partners can also allocate production for large enterprise customers, smoothing lead times.

Factory‑direct sourcing delivers performance and peace of mind. The end result is a fiber optic module factory that can guarantee the optical performance and longevity enterprises require, while offering global logistics and support. For enterprise IT buyers, this means fewer service interruptions and more predictable total cost of ownership.

Comparing Factory Offerings to Top Manufacturers

It’s useful to benchmark any factory against established optical transceiver manufacturers. Global leaders include Coherent Corp. (II‑VI, US), Cisco (US), Broadcom (US), Fibrecross (China), and others. These companies supply a full range of optics (1G to 800G) and often bundle them with switches and routers. How does a specialized factory stack up?

Product Range: Chinese vendors like Fibrecross advertise a broad portfolio of 100G, 200G, 400G, and 800G transceivers with world‑class quality. A reputable factory should match this range. In practice, many factories now produce standard 10G/25G/100G optics as well as 400G/800G pluggables (QSFP‑DD, OSFP).

Performance & Specs: Enterprises must verify specifications. Top manufacturers often publish detailed datasheets (optical budget, ER, DDM, temperature range). A quality factory will do the same. For example, modules should list parameters like average launch power, receiver sensitivity, and BER performance at max distance. Buyers should compare these to ensure parity with “brand name” optics. Factories that invest in R&D (often with the same lasers and DSP chips as OEMs) can match specifications. The real difference then is cost and support model.

Compatibility: Industry giants support all major switch platforms (Cisco Nexus, Juniper, Arista, etc.). Factories typically design optics to be plug‑and‑play per the MSA. Many now certify their modules on key switches, ensuring they pass vendor warranties. A prudent buyer should verify that factory modules are compatible with their existing hardware. Top OEMs tend to offer the broadest compatibility matrix, but factory modules can be just as universal when tested properly.

Service and Warranty: Big OEMs often provide generous warranties and global support networks. A factory (even with an international presence) may have a leaner support structure. However, many factories offer extended warranties and 7×24 technical support, especially if targeting enterprise clients. It’s important to review SLA terms. The advantage of factories is often a dedicated account manager and faster turnaround for custom orders.

A top optical transceiver factory should offer similar technical breadth as the top optical transceiver manufacturers, but with more direct engagement. Their advantage is agile customization and often lower price; OEMs may excel in branding and integrated ecosystems. Case by case, many enterprises find that factory modules deliver the same performance and compliance at a lower cost.

Key Specifications and Performance Factors

When evaluating any 800G optic—factory‑made or branded—enterprise IT buyers should focus on these specs:

Form Factor: 800G is typically QSFP‑DD or OSFP. Choose based on switch slot availability and thermal space. OSFP modules are larger but cooler, while QSFP‑DD is more compact and backward‑compatible.

Data Rate & Lanes: 800G modules use eight 100Gb/s lanes. Confirm the subtype: SR8 (8×100G over multimode, short reach), FR4/FR8 (4×200G or 8×100G over single‑mode, mid/long reach), or DR8 (8×100G over single‑mode). The choice depends on distance needs (e.g. SR8 ≈ 150–300 m, FR8 ≈ 2 km).

Optical Budget: Check transmit power, receive sensitivity, and link budget to ensure the module meets your fiber span. These influence reliability (BER) under load. High‑end factories will guarantee compliance with MSA tolerances to avoid packet loss.

Thermal/Class Temperature: 800G modules run hot. Ensure the module’s thermal design (often active heat sinks) matches your switch’s cooling. Also verify temperature range (standard 0–70 °C; extended/industrial for harsh conditions). Rigorous temperature testing is a must for reliability.

Power Consumption: 800G optics can consume up to 15–25 W. Compare datasheet power‑on voltage and max power. Efficient designs (often quoted by factories as “airflow optimized”) are preferable to reduce data center cooling load.

DDM and Management: Look for Digital Diagnostics Monitoring (DDM/DOM) per IEEE standards. Quality transceivers report real‑time power and temperature metrics for the network management system. Ensuring the factory provides full DOM support is important for maintainability.

Standards Compliance: The module should meet IEEE/ITU standards for its type (e.g. 800GBASE‑SR8, FR4, DR8). Compliance ensures interoperability. MSA compliance (e.g. QSFP‑DD MSA) guarantees form‑factor fit and pin‑out compatibility. Meeting such standards is essential to verify performance and quality.

Enterprise buyers should prioritize proven specs over brand. A capable factory will have datasheets and test reports for each optical module, showing that their units meet or exceed the OEM benchmarks.

Quality Standards and Testing

Quality is non‑negotiable for network infrastructure. A reputable fiber optic module factory maintains multiple certifications and rigorous inspection processes:

ISO 9001 & TL 9000: These QMS certifications ensure systematic quality control throughout design and production. ISO 9001:2015 helps makers keep quality high—fewer mistakes and happier customers. TL 9000 (built on ISO 9001 for telecom) adds industry‑specific metrics.

Regulatory Approvals: Transceivers typically carry CE (EMC directive for Europe), FCC (US/Canada RF emissions), and RoHS/REACH (hazardous substances) marks. These indicate that the modules have passed environmental and safety tests. Fiber optic factories also often adhere to ISO 14001 (environment management) and ISO 45001 (health & safety).

Interoperability Certifications: Many vendors certify optics on mainstream switch platforms. A quality factory should provide test reports or badges for compatibility (e.g. Cisco, Juniper, Arista).

Component Traceability: Traceability (lot/batch tracking) is key. It allows quick root‑cause analysis if a field issue arises. Serialized traceability is critical for audit compliance. Advanced factories even record raw component batch codes (e.g. laser diodes) to manage recalls or analyze failure trends.

Final QA Testing: Beyond conformity with specifications, modules undergo burn‑in tests, aging, and full function checks. For example, BER testing under stress conditions confirms the module’s real‑world data reliability.

By enforcing these standards, a fiber optic module factory delivers optics that meet enterprise‑grade expectations.

Global Sourcing Strategy: US, China, and Europe

Optical transceivers are a truly global market. Leading factories and manufacturers exist in North America, Asia, and Europe, each with pros and cons for buyers:

China: Chinese factories like InnoLight, Fibrecross, Eoptolink, and others have become major players. They often excel in price competitiveness and rapid production. Many have invested heavily in 800G R&D. Importantly, these factories have scaled to serve US and Europe customers; they maintain ISO and telecom certifications for global acceptance. The trade‑off may be political (TAA compliance or tariffs) and ensuring multi‑country inventories. Many large Chinese manufacturers now have regional warehouses to meet demand quickly.

United States: US‑based manufacturers (e.g. Coherent/II‑VI, Cisco, Broadcom) lead in integrated system solutions. They often have unmatched quality assurance and supply continuity. However, American‑made optics can carry a premium price tag. For enterprise buyers, sourcing some US‑made optics may be preferred for defense contracts or domestic security requirements. US factories may also offer faster service (local rep offices) for North American clients.

Europe: While Europe has fewer pure‑play optics factories, it’s home to many telecom integrators who use optics (e.g. Nokia, Siemens). European buyers often source optics from global suppliers with CE compliance and local support centers. Some EU‑based distributors partner with Asian factories under strict compliance frameworks. A European factory may emphasize environmental standards and data protection in sourcing (aligned with GDPR supply chain policies).

In practice, enterprise networks often adopt a multi‑sourcing strategy: mixing factories and OEMs to hedge risk. The key is to ensure that every source—regardless of region—meets the same technical and quality criteria. Many international buyers balance cost, lead time, and regulatory risk (e.g. US FRP requirements, EU cyber standards) when choosing between a Chinese factory and a Western vendor.

Conclusion: Choosing the Right Transceiver Factory Partner

A modern enterprise network needs high‑speed, reliable optical transceivers—especially as 800G becomes mainstream. Partnering directly with an experienced optical transceiver factory can unlock superior flexibility, supply assurance, and cost‑efficiency. Compared to standard optics vendors, a factory offers direct traceability, customized solutions (from 10G to 800G), and stringent testing and quality processes.

When evaluating suppliers, IT buyers should consider:

Range of Offerings: Does the factory produce the latest 800G QSFP‑DD/OSFP modules as well as legacy speeds?

Quality Certifications: Are ISO 9001/TL 9000, RoHS, CE, and FCC marks present on their products? Certificates should be available.

Testing Regimen: Do they perform full MSA‑standard electrical and optical tests (power, BER, DDM) on each module?

Supply Reliability: How do they manage capacity and inventory? Factories with multiple fabs or warehouses offer more stable deliveries.

Global Compliance: Can they meet regional requirements (e.g. TAA for US, REACH for EU)? Do they provide full source compliance reports?

In a global data‑driven landscape, the 800G optical transceiver factory is a strategic partner. By choosing a high‑quality factory that rivals top manufacturers, enterprise IT can scale networks efficiently and confidently.