What factors influence 400G optical transceiver modules price?

In the age of hyper-scaled cloud computing, edge-computing rollouts, and bandwidth-hungry applications, 400g optical transceiver modules have become a linchpin of modern network architectures. From campus backbones to metro DWDM rings and hyperscale data centers, the cost of each 400g optical transceiver can swing hundreds or even thousands of dollars. To ensure you procure the right modules at the best price, it’s crucial to understand every underlying cost driver, industry trend, and technical trade-off. This comprehensive guide dives deeper into the factors affecting 400g optical transceiver pricing and equips you with the insight to optimize total cost of ownership.

1. Form Factor and Host Compatibility

400g transceivers come in several multi-source agreement (MSA) form factors, and each carries its own development and tooling overhead:

QSFP-DD (Quad Small Form-Factor Pluggable Double-Density):

Compact “eight-lane” design compatible with most legacy QSFP cages via a mechanical adapter.

Broad OEM support helps volume-manufacturers amortize NPI (new product introduction) costs, often making QSFP-DD modules more cost-effective.

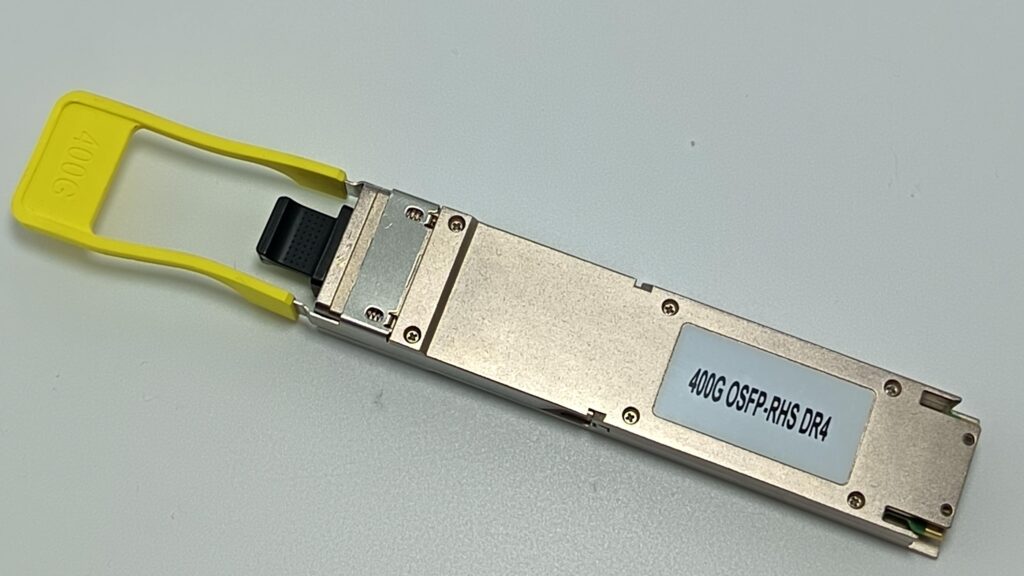

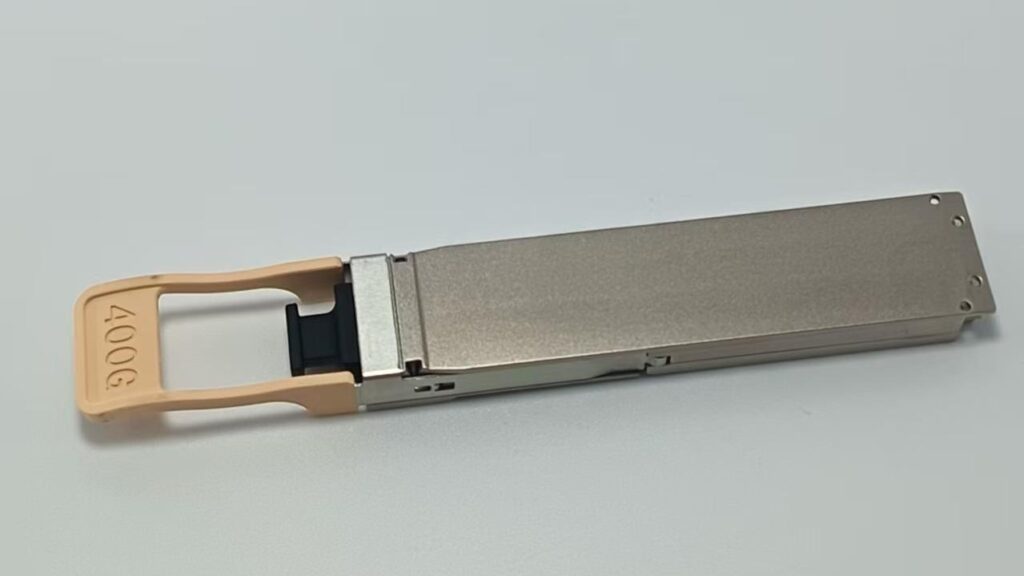

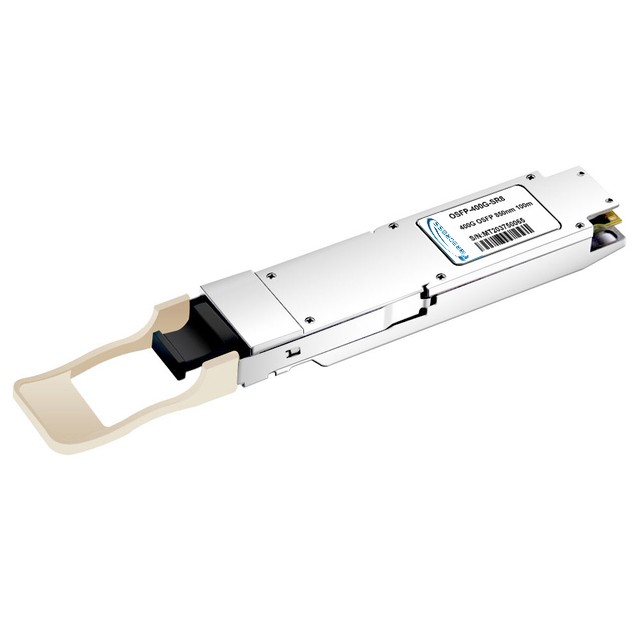

OSFP (Octal Small Form-Factor Pluggable):

Larger footprint with superior thermal dissipation—ideal for higher-power DSP chips and advanced PAM4 implementations.

The cost premium (typically 5–15 %) reflects both the larger metal housing and tooling for OSFP cages.

COBO (Consortium for On-Board Optics):

Directly solders onto the host board, offering the highest density but requiring tight board-level integration.

Niche market share means higher NRE (non-recurring engineering) and lower volumes, which can push per-unit pricing above both QSFP-DD and OSFP.

Key takeaway: Match the 400g optical transceiver module form factor to your switch/router ecosystem early in the design cycle to avoid expensive re-tooling or last-minute form-factor conversions.

2. Optical Reach, Fiber Type, and Modulation

The optical design of a 400g transceiver directly impacts BOM (bill of materials) cost and manufacturing complexity:

| Reach Type | Fiber Type | Typical Module | Optical Components | Cost Impact |

|---|---|---|---|---|

| SR4 | OM4 multimode | 100 m | VCSEL array, MPO/MTP connector | Baseline (–) |

| FR4 | Single-mode SMF | 2 km | Tunable EML laser, coarse WDM | +20–30 % |

| LR4 | Single-mode SMF | 10 km | Tunable EML laser, thin-film WDM | +30–50 % |

| ZR4 | DWDM SMF | 80 km+ | External DWDM optics, TFF filters | +60–100 % |

PAM4 vs. NRZ: Most 400g modules rely on PAM4 signaling to double data-rate over each lane. The advanced DSP required for PAM4 adds around 20–40 % to DSP chip costs compared with NRZ-based 100 G modules.

DWDM versions: 400G ZR4 and Open-ZR+ modules for metro and long-haul networks incorporate external optical amplifiers and tighter channel spacing, dramatically increasing per-unit costs but unlocking new market opportunities.

3. Strategic Sourcing: Brands, Warranties, and Certification

Tier-1 OEMs (e.g., Cisco, Juniper, Arista):

Price premium of 20–30 % above generic “white-box” 400g optical transceiver modules.

Extended warranties (2–3 years) and certified interoperability lists minimize network integration risk.

ODM/OEM partners and Third-Party Vendors:

Lower list prices—often 10–20 % below OEMs—thanks to higher production volumes and lean supply chains.

Standard warranties of 1 year, optional extension programs available at extra cost.

Certification fees: Vendors pay switch-vendor license fees to test and certify modules for specific platforms. These fees, spread across total shipments, can add an implicit 5–8 % markup to each 400g transceiver.

Tip: Budget not only for the module cost but also for any license or certification fees you’ll need to participate in “guaranteed-interoperability” programs.

4. Component and Raw‐Material Price Volatility

Key optical and electrical components drive the bulk of BOM expenses:

DSP chipset: $150–300 per unit, sourced from a handful of global fabless suppliers.

Laser diodes:

VCSELs for SR4: Relatively low cost and high yield.

EML/DFB for FR4/LR4: $100–200 premium per module.

Connectors and metals: Gold plating on MPO/MTP ferrules, specialty alloys for heat sinks, and engineered plastics for housing tolerances.

Inflationary pressures: Sharp rises in gold, copper, and semiconductor wafer costs have historically led to 5–10 % price fluctuations quarter over quarter.

Supply-chain constraints: Events such as silicon-wafer shortages, regional lockdowns, or shipping disruptions can introduce spot-buy premiums of up to 25 % for urgent orders of 400g optical transceivers.

5. Testing, Quality Control, and Regulatory Compliance

To guarantee reliable operation over the lifetime of your network, every 400g optical transceiver undergoes detailed testing:

Electrical and Optical Characterization:

Bit-error-rate (BER) testing at multiple data rates and temperatures.

Eye-diagram analysis for each lane to ensure compliance with IEEE and MSA masks.

Environmental Stress Screening:

Temperature cycling from –40 °C to +85 °C, vibration testing for data-center rack transport scenarios.

Standards and Certifications:

RoHS, REACH environmental directives: Documentation and compliance testing add 3–5 % to costs.

Regional telecom approvals (FCC, ETSI): 2–3 % additional testing fees.

Extended reliability programs—such as burn-in testing beyond 1 000 hours or accelerated life testing—can tack on another 10–15 % but dramatically lower field failure rates.

6. Market Dynamics and Volume Discounts

Hyperscale vs. Enterprise Purchases:

Orders of 10 000+ units may unlock 30–40 % volume discounts off list price.

Small to medium-sized businesses buying 10–100 units typically pay within 5–15 % of list price, plus handling fees.

Inventory cycles: Off-peak seasons can yield clearance-sale pricing when manufacturers clear excess stock. Conversely, pre-new-product-launch surcharges often apply when inventory runs tight.

Effective procurement strategies—such as multi-year volume commitments or cross-vendor bidding—can stabilize pricing and secure capacity during supply-chain uncertainty.

7. Logistics, Duties, and After-Sales Support

| Cost Element | Typical Range |

|---|---|

| Air vs. Sea Freight | +10–30 % (air) |

| Customs Duties & VAT | 2–5 % |

| Expedited Handling Fees | 5–15 % |

| On-Site Installation | $200–$500 per day |

| Extended SLAs & RMA | 3–8 % of module cost |

Consider “door-to-rack” vs. “FOB factory” pricing when comparing vendor quotes. Factor in import duties and value-added taxes, especially for large deployments in the EU, USA, or APAC.

8. Total Cost of Ownership (TCO) and ROI Considerations

While upfront module price is critical, other factors drive overall network economics:

Power consumption and cooling: Higher-power DSPs in PAM4 modules raise data-center PUE by 0.01–0.03 points per kW.

Module lifetime and failure rates: A 0.5 % annual failure rate can translate into unplanned replacement costs of $10–20 k for every 1 000 modules deployed.

Scalability: Future-proofing with interoperable form factors (QSFP-DD, OSFP) can extend refresh cycles and defray upgrade costs.

Quantifying these elements alongside unit pricing yields a more holistic investment picture.

9. Emerging Trends Impacting 400G Pricing

Silicon Photonics Integration: Co-packaged optics (CPO) promise to collapse power and cost by integrating optical engines directly onto switching ASICs—potentially reducing module BOM costs by 30–40 % within the next 3–5 years.

Standardization of Open-Line Systems: Disaggregation of line-side optics from ROADMs may commoditize long-haul 400g modules, pressuring prices downward.

Sustainability and Recycling Programs: Vendors offering module take-back or refurbishment services are beginning to bundle these as value-adds, altering lifecycle cost models.

Staying ahead of these trends can guide your future procurement and budget planning.

About Fibrecross:

Fibrecross is your trusted source manufacturer of 400g optical transceiver modules in the B2B industry. Made in China, we offer global distribution, sufficient inventory, and fast delivery—ensuring you get high-quality 400g optical transceivers exactly when and where you need them.

Conclusion

The 400G optical transceiver modules price is far more than a list number: it’s a culmination of form-factor design, optical reach, component sourcing, testing rigor, market conditions, and operational economics. By dissecting each cost driver—and aligning them with your technical requirements, budget constraints, and future roadmap—you can achieve the optimal balance of performance, reliability, and total cost of ownership.